The Bank of England has released its long-awaited consultation paper on regulating sterling-denominated systemic stablecoins, setting out a multi-stage process running through 2026. Governor Andrew Bailey said the proposals aim to ensure public trust in new digital forms of money while supporting innovation in UK payments.

The consultation follows new powers granted under the Financial Services and Markets Act 2023, which expanded the Bank’s remit to digital settlement assets. Once HM Treasury recognises a stablecoin issuer as systemic, the Bank and Financial Conduct Authority will regulate the firm jointly.

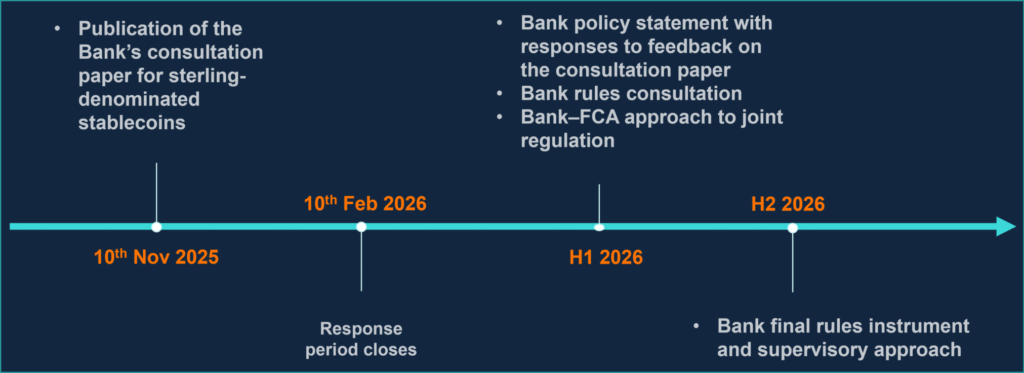

Timeline of the Bank’s Stablecoin Consultation

The timeline shows the publication of the consultation on 10 November 2025, the response deadline on 10 February 2026, and a series of policy deliverables through the first and second halves of 2026. These include the Bank’s formal policy statement, a joint Bank–FCA regulatory approach, and the publication of final rules and supervisory expectations later in the year.

Revised Backing Model for Systemic Stablecoins

At the centre of the Bank’s proposals is a revised model for backing assets. Earlier plans required 100% unremunerated central bank deposits, but industry respondents said this would make business models unviable and diverge from international frameworks. The Bank now suggests a 40:60 split: at least 40% of backing assets in unremunerated central bank deposits and up to 60% in short-term UK government debt.

The central bank deposits would provide immediate liquidity during redemptions, while the government securities would allow issuers to earn returns and operate sustainably. Temporary deviations from this ratio will be permitted in stress periods, provided issuers notify the Bank and submit a replenishment plan.

The Bank is also considering limited access to a liquidity backstop for solvent and viable stablecoin issuers, which could help stabilise markets during large or unexpected redemption events.

Joint Oversight and Market Structure

The consultation highlights the UK’s ambition to develop a “multi-money” ecosystem, integrating stablecoins, tokenised bank deposits and central bank money. To support this, the Bank will work through the new Retail Payments Infrastructure Board and the Digital Securities Sandbox to ensure interoperability.

Table A in the consultation outlines how different use cases — from retail payments to wholesale financial market settlement — determine whether a stablecoin issuer is regulated by the Bank, the FCA, or both. Stablecoins used solely for crypto-asset trading or on a small scale would remain under FCA oversight.

Looking Ahead to 2026

The Bank received 46 responses to its earlier discussion paper, with industry calling for better alignment with international regimes and a smoother path from non-systemic to systemic oversight. The new proposal includes a step-up regime for issuers recognised as systemic at launch, allowing up to 95% backing in government securities during early growth before moving to the standard 60% threshold.

Final rules are expected in the second half of 2026. If implemented as proposed, the regime would create one of the clearest environments globally for stablecoin-based payment systems while reinforcing the Bank’s focus on preserving monetary and financial stability.