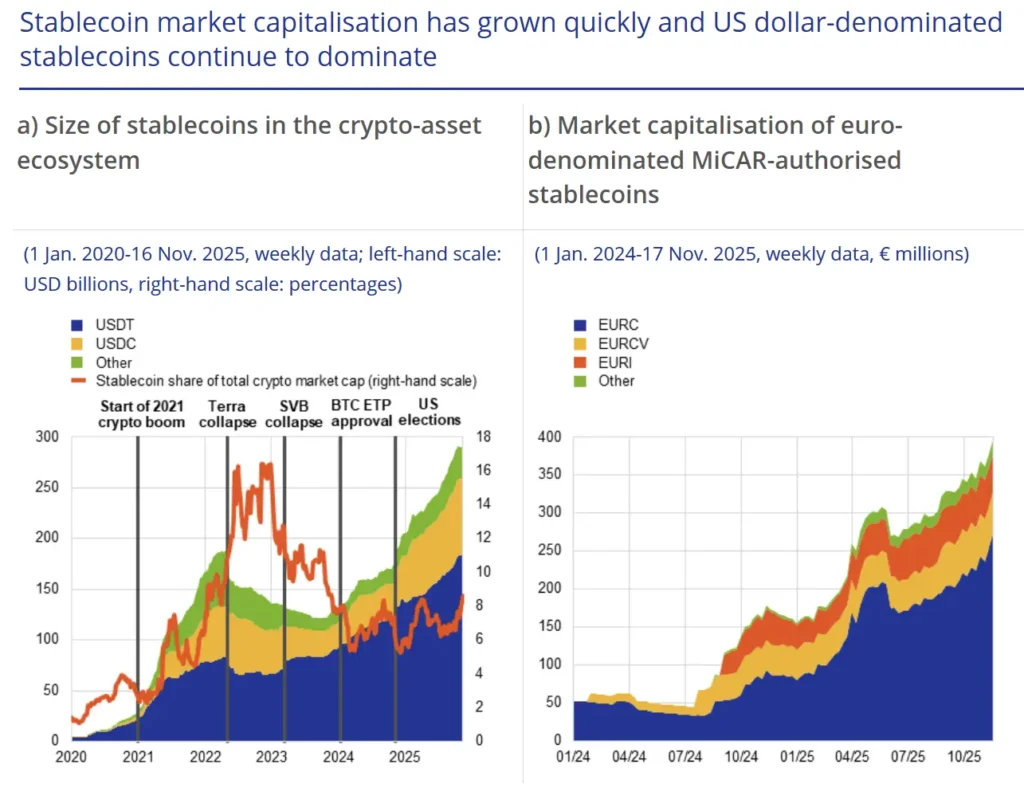

Stablecoins have reached a new all-time high in global market capitalisation, surpassing USD 280 billion and accounting for around 8 percent of all crypto assets. According to recent analysis prepared by Senne Aerts, Claudia Lambert and Elisa Reinhold, the continued rise of these dollar-pegged instruments is drawing increased scrutiny from policymakers concerned about financial stability.

Two issuers dominate the sector. Tether’s USDT and Circle’s USDC now hold USD 184 billion and USD 75 billion in circulation respectively, making up nearly 90 percent of stablecoin supply. While the market is overwhelmingly denominated in U.S. dollars, euro-denominated stablecoins remain relatively small, totalling just €395 million. Analysts note that a clearer regulatory environment, including the EU’s Markets in Crypto Assets Regulation, may have helped accelerate demand globally.

Crypto trading drives most stablecoin use

Trading remains the core purpose of stablecoins. Roughly 80 percent of transactions on centralised crypto exchanges involve USDT or USDC, underlining their role as a bridge asset for traders. Other use cases, including cross-border payments and retail savings in emerging markets, appear far smaller than often claimed. Research suggests that organic retail transactions amount to only about 0.5 percent of total volumes.

Stablecoins’ dependence on confidence is central to their vulnerability. A loss of trust in an issuer’s ability to redeem tokens at par can trigger runs and sudden de-pegging events. The collapse of TerraUSD and the temporary de-pegging of USDC during the Silicon Valley Bank failure showed how quickly these shocks can spill over into broader crypto markets.

Growing interlinkages with traditional finance

The report highlights that the largest stablecoin issuers are now significant holders of traditional financial assets, especially U.S. Treasury bills. Combined, USDT and USDC maintain reserve portfolios comparable to the world’s largest money market funds. This deepening connectivity creates a potential channel of contagion. A run on a major stablecoin could force large asset sales, potentially disrupting short-term funding markets.

Some projections estimate that stablecoin market capitalisation could reach USD 2 trillion by 2028 if current growth rates persist. Concentration adds further risk, with just two issuers controlling most supply and creating a single point of failure for global markets.

Implications for banks and deposit stability

If stablecoins gain wider use beyond crypto trading, the euro area banking sector could face deposit outflows. Households moving funds into stablecoins could reduce the volume of retail deposits, which are generally a stable funding source for banks. Wholesale inflows linked to stablecoin reserve holdings would only partially offset these losses and would be more volatile. MiCAR prohibits interest payments on stablecoin holdings in Europe, but similar restrictions do not yet exist in all jurisdictions.

Regulatory fragmentation raises spillover concerns

The authors identify regulatory discrepancies between jurisdictions as the main source of risk for the euro area. Differences in reserve rules, redemption rights and permissible fee structures create opportunities for regulatory arbitrage. A particular concern is so-called third-country multi-issuance, where a single stablecoin is jointly operated by EU and non-EU entities under different supervisory regimes. This could leave EU-supervised issuers with insufficient reserves to meet combined redemption requests during stress events.

Calls for global coordination

The report concludes that stablecoin-related risks in the euro area remain contained today, given their limited domestic use and the dominance of dollar-based tokens. However, rapid growth, increasing financial linkages and persistent regulatory asymmetries justify close monitoring. Policymakers argue that stronger global coordination is needed, particularly through implementation of the G20 crypto-asset roadmap and the Financial Stability Board’s recommendations on stablecoin arrangements.

As stablecoins grow in scale and relevance, the euro area may face rising spillover risks unless key jurisdictions converge on common standards for reserve quality, redemption rights and operational transparency.