Central banks are intensifying exploration of tokenized reserves as they assess the future of wholesale money in an increasingly digital financial system, according to a new Fintech Note published by the International Monetary Fund. The 40-page study, Central Bank Exploration of Tokenized Reserves, provides one of the most comprehensive assessments to date of how central banks are evaluating distributed ledger technology (DLT) for interbank settlement .

The report explains that tokenized reserves, sometimes referred to as wholesale CBDC, represent central bank liabilities issued on DLT and accessible only to licensed financial institutions. The authors stress that wholesale reserves already exist in digital form today, meaning tokenization changes only the settlement technology rather than the fundamental nature of the money itself .

Efficiency, automation, and policy control

According to the IMF, the strongest motivation for tokenized reserves is the need to preserve the role of central bank money within emerging tokenized financial markets. As banks and asset managers experiment with tokenized bonds, funds, and securities, policymakers want to ensure that settlements can occur in risk-free central bank money rather than in private tokens or stablecoins.

The paper highlights potential efficiency gains, including atomic settlement, programmable workflows, and real-time liquidity management. These capabilities could reduce operational risk and lower costs across financial market infrastructures. The authors also note that tokenized reserves could enhance resilience by enabling distributed models of operation rather than single-point central databases.

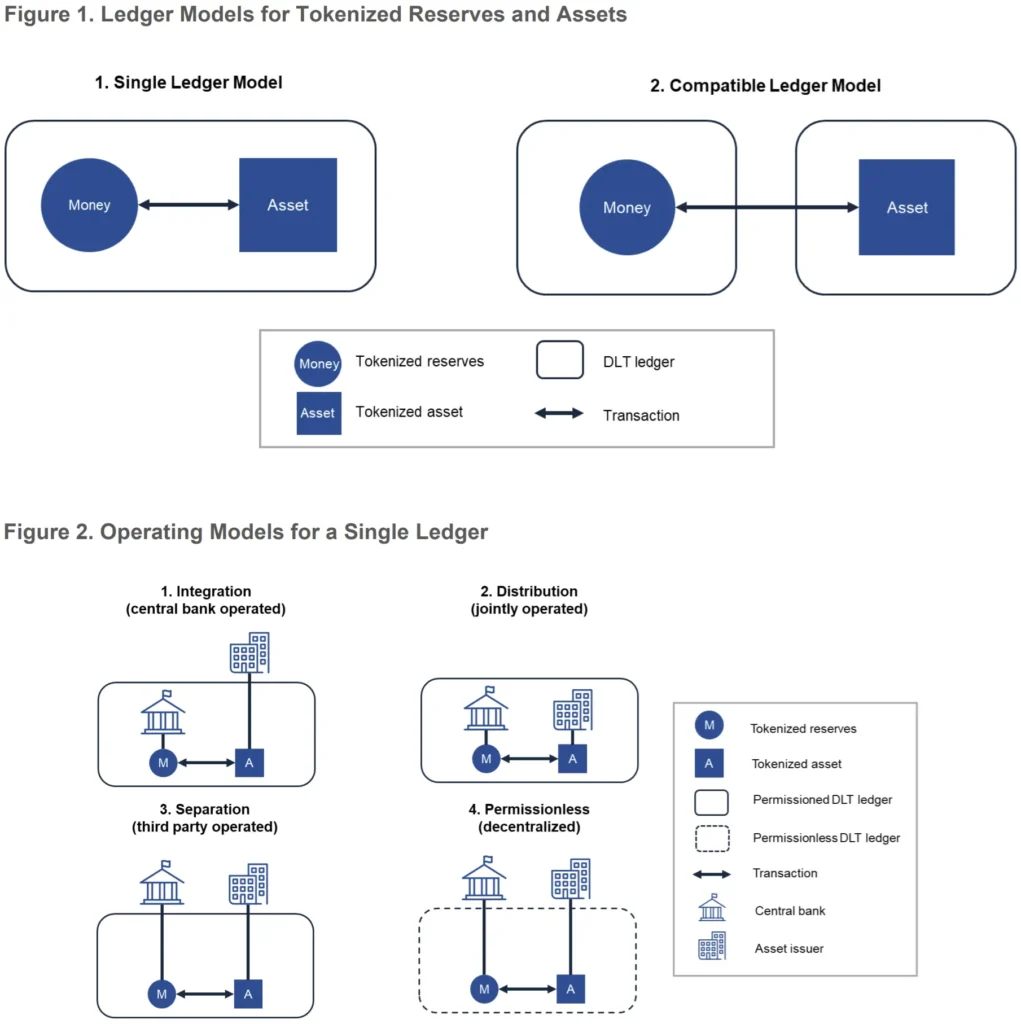

However, the IMF cautions that any adoption must align with a jurisdiction’s policy goals, including control over issuance, access rights, and data governance. Decisions about whether to use a single ledger, interoperable platforms, or hybrid models will directly influence risk exposure and operational complexity.

Technology choices and implementation risks

The report evaluates several design models, ranging from fully integrated systems in which central bank money and tokenized assets coexist on a single ledger, to “interconnected” models that link DLT platforms with traditional RTGS systems. Charts in the Note, including Figure 1 and Figure 2, illustrate how ledger architecture impacts settlement flows, privacy, and the distribution of responsibilities between central banks and market infrastructures .

Implementation challenges remain substantial. These include governance of shared ledgers, maintaining system continuity during outages, and ensuring compliance with AML and data-protection rules. For monetary policy, the IMF finds that tokenization does not fundamentally alter a central bank’s ability to steer interest rates but may require updates to liquidity management frameworks.

Alternatives: links, omnibus accounts, and private solutions

Not all jurisdictions are likely to issue tokenized reserves. The paper lays out three alternatives: enhanced RTGS-DLT links, tokenized omnibus accounts, and privately issued tokenized money. Each option carries different trade-offs in terms of risk, control, programmability, and cost.

A comparison table in the Note shows that while private options may innovate quickly, they often do not meet the safety or policy requirements central banks demand for high-value wholesale settlement. By contrast, central banks retain maximum control with tokenized reserves, though this approach requires heavier investment and coordination with industry stakeholders.

A cautious but accelerating global shift

The IMF concludes by encouraging central banks to clarify strategic objectives, assess market readiness, and adopt phased testing. The Note points to several ongoing pilots, including Switzerland’s Project Helvetia and cross-border DLT experiments overseen by the BIS Innovation Hub, as examples of how jurisdictions are moving from research to live experimentation.

For Europe, the findings arrive as the ECB scales up digital euro work and explores how tokenization could reshape capital-market infrastructures. The analysis suggests that wholesale innovation may advance more quickly than retail CBDCs, given strong industry demand for more efficient settlement rails.

As tokenization spreads across global finance, the IMF’s assessment signals that central banks increasingly view upgraded forms of wholesale money as essential to safeguarding stability, sovereignty, and market integrity in the digital era.