A pilot project involving Siemens, Accenture, and the European Central Bank is providing one of the clearest illustrations yet of how a future digital euro could support automated business-to-business payments tied directly to real industrial processes.

The experiment, conducted under the ECB’s digital euro Innovation programme, explored how machines can trigger payments automatically as production and logistics milestones are reached, without turning money itself into a fully programmable asset. The approach is best understood as a sequence of machine-verified events, each linked to a conditional payment step, rather than a traditional invoice settled after delivery.

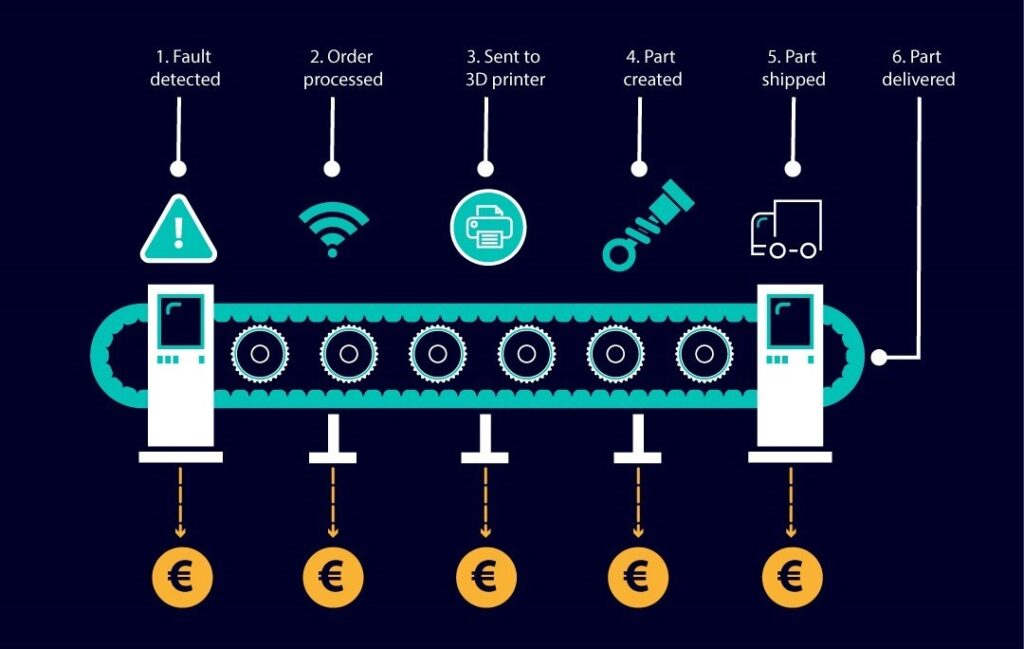

The logic of the pilot can be visualised as a sequence of machine-verified production and logistics events, each linked to a conditional payment step.

From fault detection to settlement

The pilot can be visualised as a linear workflow inside an automated factory. First, a machine detects a fault in its operation, for example a worn conveyor component. Instead of escalating the issue to a human buyer, the system processes an order automatically and sends it to an internal additive manufacturing setup.

A 3D printer then produces the spare part on demand. As the part is created, shipped and ultimately delivered, each step acts as a factual trigger for the next payment action. Rather than paying the full amount upfront, funds are reserved and released incrementally as value is delivered.

This step-by-step logic, illustrated in the accompanying diagram, shows how money can move in sync with physical production. Euro-denominated payments are released only when predefined conditions are met, aligning cash flows precisely with operational reality.

Why conditional payments matter

According to Heiko Nix, who described the project in a LinkedIn post, the objective was to “capture practical CBDC design and conditional payment learnings from the real world” and to create a template for connecting manufacturing and finance end to end.

Linking operational events directly to automated payments removes what Nix calls “artificial boundaries” such as prepayments, safety stocks and working capital buffers. In a traditional setup, these buffers exist largely because production, billing and settlement are disconnected. Conditional payments allow customers, manufacturers, suppliers and shippers to operate within a shared workflow, with payments triggered only when a production or logistics milestone is reached.

Crucially, the pilot did not involve real money. Only theoretical tokens were moved. The value of the exercise lay in understanding process integration, governance and liquidity dynamics rather than settlement itself.

Why the digital euro was chosen

From Siemens’ perspective, the underlying payment rail was not the primary focus. Nix stressed that the same logic could run on existing real-time payment systems, such as SEPA Instant Payments. The digital euro was chosen because of its future-oriented nature and its potential reach across the euro area.

Another factor was functionality. A digital euro could support the reservation of funds in advance and their release upon a business event, a feature today most commonly associated with card payments. This gives suppliers confidence that liquidity is committed, while allowing buyers to retain control until goods are actually delivered.

The technical architecture behind the pilot

The technical orchestration layer was developed by Accenture. In a separate LinkedIn post, Nils Beier explained how a Conditional Payment Module acted as the bridge between Siemens’ production systems and the ECB’s Digital Euro Service Platform.

Industrial events were translated into payment instructions using smart contract logic built on Hyperledger Fabric, supported by open APIs. A strong governance framework was embedded to ensure that machine-triggered actions operated strictly within predefined rules.

One key design choice was that machines themselves do not hold money. They act as trusted trigger points, while liquidity remains centrally managed on corporate accounts or wallets under treasury control. This avoids the operational and risk complexity of distributing balances across individual machines.

Implications for treasuries and policymakers

For corporate treasuries, the pilot points toward a shift from manual transaction processing to overseeing automated, data-driven workflows. When billing and payment occur synchronously, cash application becomes simpler and more accurate, and liquidity can be optimised until the last possible moment.

For policymakers, the Siemens use case reinforces the ECB’s emphasis on conditional, rather than fully programmable, money. It shows how a digital euro could support automation and machine-to-machine commerce while preserving legal certainty, public governance and monetary control.

As the ECB continues its preparation work toward the end of the decade, this type of industrial pilot suggests that some of the most transformative digital euro use cases may emerge quietly in the background of Europe’s manufacturing and supply chains, long before consumers ever pay with it at a checkout.

Related: ECB Outlines Core Design Features for the Digital Euro in New Technical Annex