Bitcoin mining profitability has reached its most severe compression on record, according to new data from TheMinerMag. Hashprice, which averaged around $55 per petahash per second in the third quarter, has fallen to approximately $35 as Bitcoin declined sharply in November. At these levels, profitability pressure has become systemic across the sector.

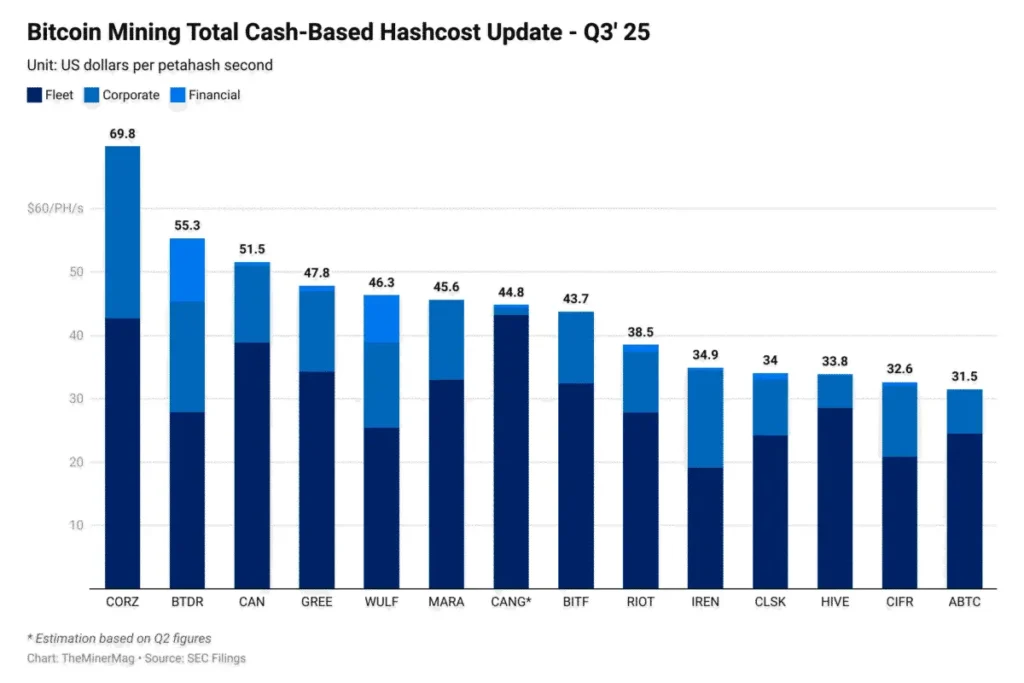

TheMinerMag’s latest Q3 report shows that the median total hashcost for major public miners sits near $44 per PH per second. This figure includes cash operating costs, corporate overhead, and financing expenses. Even firms running highly efficient fleets and competitively priced power contracts are now operating near break-even.

Hashcost Becomes the Sector’s Primary Stress Indicator

With network hashrate hovering around 1.1 zettahash per second, cost per bitcoin mined no longer reflects economic reality. Hashcost, a metric that normalizes difficulty changes, highlights the widening gap between miners’ expenses and the marginal revenue available in the current downturn. Machine payback periods now exceed 1,000 days for the latest-generation rigs, surpassing the roughly 850 days remaining until the next halving.

Balance sheet moves show how quickly the industry is responding. CleanSpark recently repaid its bitcoin-backed credit line with Coinbase only weeks after raising more than $1 billion in convertible debt. The decision underscores a shift toward deleveraging and liquidity preservation at a time when hashprice has reached historic lows.

The funding landscape is also changing. Public miners raised an estimated $3.5 billion in debt during Q3, largely through near zero coupon convertible notes. Equity financing added another $1.4 billion. But early Q4 activity shows a pivot to higher cost senior secured notes with yields near 7 percent, with Cipher and Terawulf together raising close to $5 billion. If volumes continue, Q4 could become the largest debt raising quarter in the industry’s history.

A key question now is whether high performance computing and AI related revenue streams can scale quickly enough to offset collapsing mining margins and growing debt obligations. Early revenue data suggests progress but remains far below what would be required to sustain miners through prolonged weakness in hashprice.

For the moment, the trend appears clear. Bitcoin mining is entering a sorting phase, according to TheMinerMag, one that may expose structural weaknesses among operators unable to withstand extended periods of suppressed economics.