The European Central Bank’s latest consumer research suggests that a digital euro would mainly be used as a means of payment rather than as a substitute for bank savings, easing concerns about large-scale deposit flight. The findings are based on micro-level data from the ECB’s Consumer Expectations Survey and are published in Research Bulletin No. 138, released on 22 December 2025.

According to the study, many euro area consumers are open to using central bank money in digital form, but primarily for everyday transactions. Under normal, non-crisis conditions, the authors estimate that the introduction of a digital euro would lead to only a small reallocation of liquidity away from commercial bank deposits.

The research draws on survey responses from households across the 11 largest euro area countries. It examines awareness of the digital euro, willingness to adopt it, and how consumers say they would adjust their financial portfolios if such a currency were available.

Awareness is rising, but remains incomplete

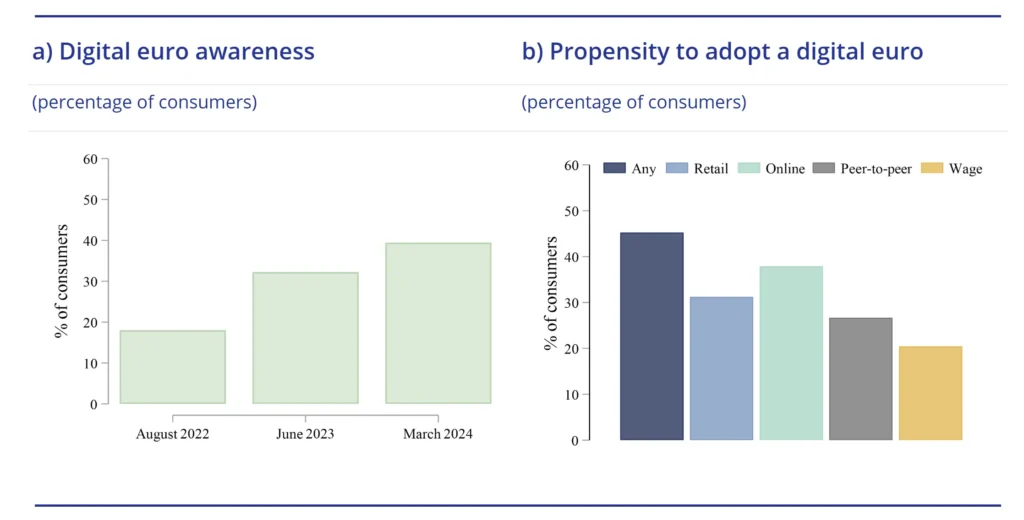

Consumer awareness of the digital euro has increased markedly in recent years, reflecting intensified public communication by the ECB. Survey data show that awareness rose from below one-fifth of consumers in 2022 to around 40 percent by March 2024.

Despite this progress, a majority of consumers still report limited familiarity with the project. This gap helps explain why adoption intentions, while significant, are not universal.

In the March 2024 survey round, about 45 percent of respondents said they would be likely to use a digital euro in their daily lives. Interest is strongest for online purchases and in-person retail payments, rather than for uses such as receiving salaries.

Younger consumers, higher-income households and those with higher education levels show a greater willingness to adopt. Among respondents aged 18 to 34, around 55 percent said they would probably use a digital euro for at least one purpose. The authors note that these differences underline the importance of financial inclusion in the design and rollout of any retail central bank digital currency.

Limited impact on household portfolios

A central concern in the digital euro debate is whether easy access to central bank money could drain deposits from commercial banks and threaten financial stability. The study addresses this by asking households how they would allocate funds under hypothetical scenarios.

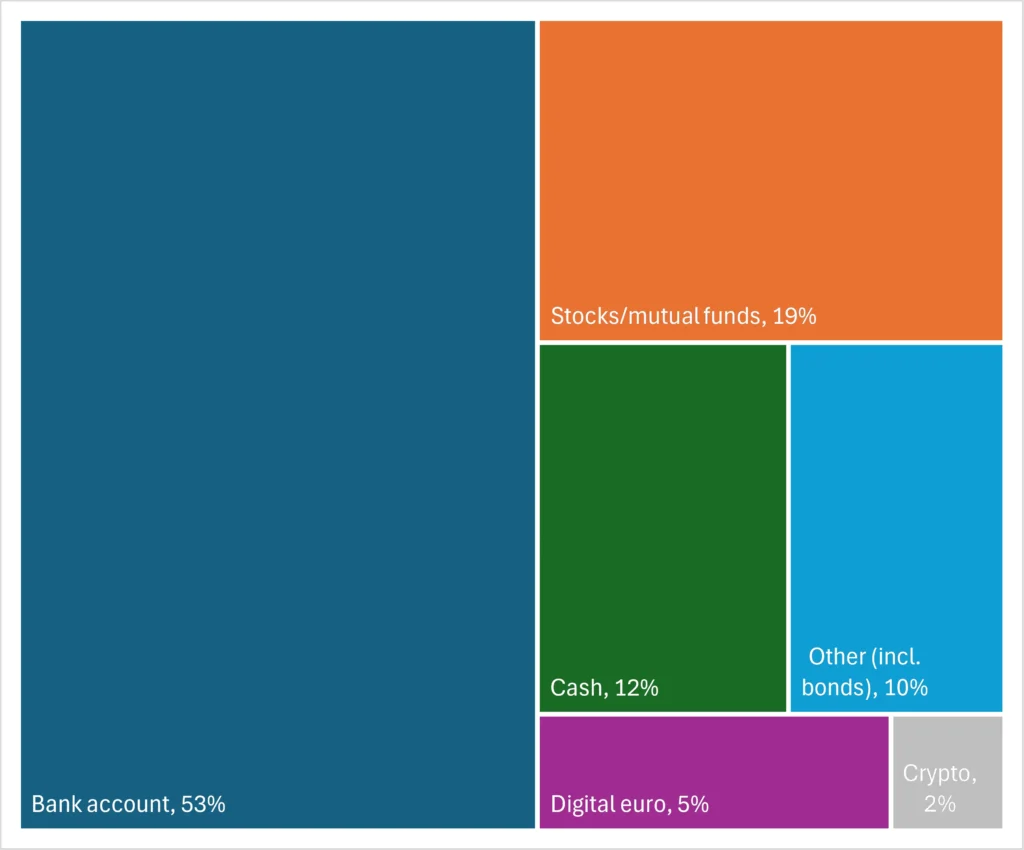

When respondents were asked how they would distribute a €10,000 windfall across different assets, only about 5 percent was allocated, on average, to a digital euro. By contrast, more than half of the funds were assigned to current or savings accounts, while 12 percent went to physical cash.

These results suggest that consumers view a digital euro more like digital cash than a savings or investment vehicle. Even when holding limits between €1,000 and €10,000 were introduced, the size of the cap had no noticeable effect on how much of their liquid assets respondents said they would move into a digital euro.

The authors conclude that, under normal conditions, such behaviour is unlikely to trigger significant financial disintermediation.

Communication matters, but effects fade

The study also highlights the role of communication. In a randomised experiment embedded in the survey, some respondents were shown an official ECB video explaining the digital euro’s features and uses.

The impact was sizeable. For example, the likelihood of using a digital euro for offline retail payments increased by 13 percentage points among those who watched the video. However, follow-up data suggest that the effect fades over time, indicating that one-off communication is not sufficient.

Overall, the research supports the ECB’s position that a well-designed digital euro, combined with clear and ongoing communication, could coexist with bank deposits without undermining financial stability. At the same time, it suggests that sustained public engagement will be essential if the digital euro is to achieve broad and inclusive adoption across the euro area.