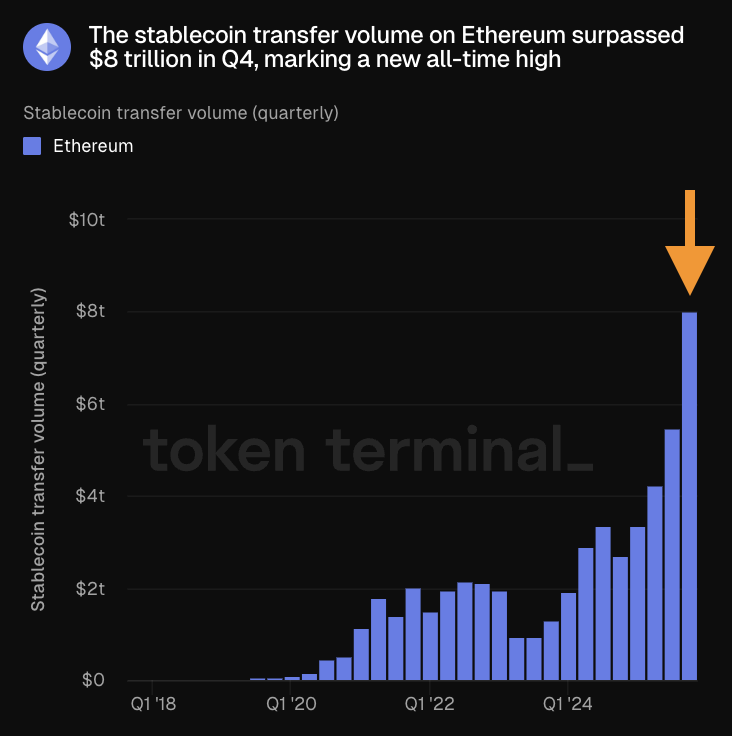

Ethereum processed more than $8 trillion in stablecoin transfers in the fourth quarter, a new all-time high that is reshaping how policymakers view the future of digital money. The milestone highlights how private, dollar-denominated stablecoins have quietly become a core payments layer, just as Europe debates whether and how to introduce a digital euro.

Drawing on on-chain analytics from Token Terminal and Blockworks, the data show that stablecoin transfer volumes on Ethereum nearly doubled compared with earlier quarters. Network activity also surged, with transaction counts and active addresses reaching record levels toward the end of the year.

For much of the crypto market’s history, stablecoins were framed mainly as trading tools. That narrative is becoming harder to sustain. At $8 trillion in quarterly volume, stablecoin flows on Ethereum now rival the annual payment throughput of major global card networks. While not all transfers represent retail payments, the scale suggests that blockchain rails are increasingly being used for treasury operations, cross-border settlements, and real-world financial activity.

Token Terminal described the surge as a clear sign of growing economic usage, rather than short-term speculation. Blockworks’ analytics dashboards point in the same direction, showing sustained growth in both stablecoin supply and transfer activity across the Ethereum network.

Why this matters for Europe

For European policymakers, the numbers land at an uncomfortable moment. The European Central Bank has repeatedly warned that foreign stablecoins could weaken Europe’s monetary sovereignty if they become widely used for everyday payments. The latest data shows that this risk is no longer theoretical.

Most stablecoins circulating on Ethereum are pegged to the US dollar. As their usage grows, so does the potential for dollar-based digital money to gain ground in international payments, including within the EU. That dynamic has been one of the core arguments behind the ECB’s push for a digital euro.

The contrast is stark. While stablecoins already settle trillions in value each quarter, the digital euro remains in its preparation and legislative phase. The ECB argues that a public digital currency would offer legal certainty, consumer protection, and offline functionality that private issuers cannot guarantee.

Yet the market momentum clearly sits elsewhere for now. Stablecoins are live, programmable, and deeply integrated into global crypto infrastructure. They are also increasingly being adopted by fintechs and payment providers as settlement assets.

A widening gap between policy and practice

The $8 trillion figure sharpens a key question for Europe: can a digital euro realistically compete with private stablecoins on usability and scale, or is its role primarily defensive?

Officials at the European Central Bank have stressed that the digital euro is not designed to replace private innovation, but to anchor it. The idea is that public digital money would coexist with stablecoins, providing a trusted reference point and a European alternative.

However, as stablecoin volumes continue to accelerate, timing becomes critical. Each quarter of delay widens the gap between existing private payment rails and a still-hypothetical public one.

For banks, merchants, and payment providers across Europe, the implications are practical rather than ideological. Stablecoins already offer instant settlement and global reach. Whether the digital euro can match those features, while preserving public oversight and financial stability, will be decisive.

The record-breaking quarter on Ethereum does not settle the debate. But it does raise the stakes. Digital money is no longer a future concept. It is already moving trillions.