The United States’ new Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act is intensifying debate over whether stablecoin issuers are becoming a structural source of demand for U.S. government debt. Signed into law in July 2025, the act introduces the country first federal framework for payment stablecoins, tightly restricting how issuers hold and manage reserves.

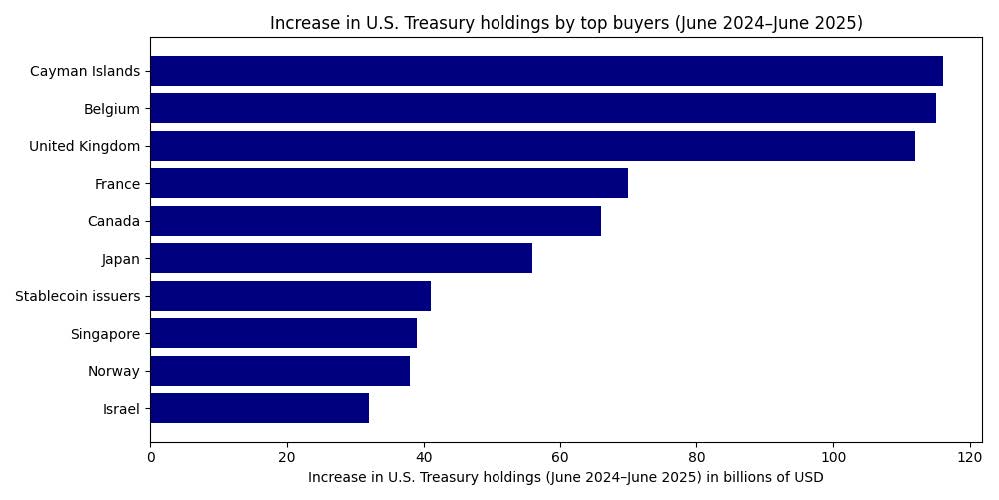

Under the law, entities issuing U.S. dollar-denominated payment stablecoins must back their tokens one-to-one with liquid assets including cash, Federal Reserve balances, insured deposits and short-maturity Treasuries. These requirements formalise the reserve structure already used by major issuers such as Tether and Circle, which collectively held $177.6 billion in Treasuries by mid 2025. That level made stablecoin issuers the seventh-largest purchaser of U.S. debt between June 2024 and June 2025.

How the Act Channels Capital into U.S. Debt

The GENIUS Act prohibits stablecoin issuers from offering interest or engaging in broader lending activities, effectively funneling reserve portfolios into the safest and most liquid government instruments. Analysts cited in the report argue that each new digital dollar minted is effectively paired with a mandated purchase of U.S. sovereign debt, turning issuers into a pipeline between global users and the Treasury market.

The White House has explicitly acknowledged this outcome, stating that the law will generate additional demand for U.S. debt and strengthen the dollar reserve-currency role. This openness has led some commentators to call the mechanism a form of “non-stealth” debt financing embedded into private digital-dollar infrastructure.

Stability Benefits, New Vulnerabilities

Researchers warn that while the system supports cheap government financing, it also concentrates risks. Heavy exposure to short-term Treasuries makes stablecoin issuers sensitive to liquidity shocks during market stress or rapid redemptions. A severe outflow event could force issuers to unload large volumes of Treasury bills, driving yields higher and stressing the broader market.

The law also permits the use of Treasury repos as reserve assets, raising concerns because repo contracts are exempt from automatic stay in bankruptcy. If an issuer were to fail, repo counterparties could seize collateral, potentially leaving insufficient reserves to honor withdrawals. Some analysts advocate tighter limits on repos and stronger capital buffers to reduce systemic vulnerabilities.

Are Issuers Really “Stealth” Buyers?

Despite headlines, the framework includes mandatory monthly disclosures of reserve composition audited by independent third parties. This means holdings of Treasuries are visible to regulators and the market, reducing the stealth element often associated with stabilizing flows. The law also allows modest diversification into government money-market funds and Federal Reserve balances, although the economic incentives still tilt heavily toward Treasuries.

Implications for Europe and Global CBDC Policy

Europe continues to debate the future of public digital money, and the U.S. model may influence regulatory thinking. If the GENIUS Act succeeds in reinforcing the dollar’s dominance by tying global stablecoin usage to Treasury demand, EU policymakers may see additional urgency in developing a competitive digital euro.

For now, the GENIUS Act marks a turning point. Stablecoins, once dismissed as a niche crypto innovation, are increasingly entangled with sovereign debt markets, shaping both financial-stability debates and the geopolitics of digital currency.